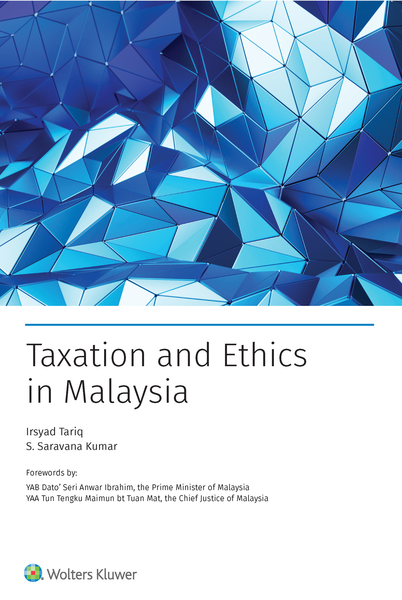

The Malaysia Master Tax Guide offers a reliable, practical, and precise summary of the structure, key features, and coverage of Malaysia's income tax laws and practices. It explains how tax legislation applies to individuals, companies, partnerships, limited liability partnerships, and other taxable entities. The guide also includes vital information on stamp duty, real property gains tax, capital gains tax, double tax agreements, and investment incentives. By using this resource, readers will gain clearer insights into statutory tax requirements, including how to prepare and file tax returns and address tax-related disputes. For over 40 years, this annually updated guide has been recognised as Malaysia’s most trusted tax reference, presenting yearly tax changes in a clear and concise format.

Why You’ll Appreciate It

This guide serves as a thorough and practical reference to Malaysia’s tax system. It features up-to-date legislation, tax rates, and reference tables, complemented by real-world tax calculation examples. With its intuitive layout, helpful cross-referencing, and easy-to-navigate tools, users can quickly find answers to their tax questions.

Highlights of Malaysia Master Tax Guide, 42nd Edition:

-

Updated Content: Reflects all tax updates since the 2024 edition, including changes from the 2025 Budget, new exemption orders, rules, and recent court decisions.

-

Extensive Coverage: Provides in-depth insights into Malaysia’s income tax framework, supported by practical examples.

-

Ease of Use: Designed with comprehensive cross-references, a detailed index, and useful navigation tools.

-

Practical Illustrations: Includes revised and newly added examples to clarify tax scenarios.

-

Reliable Information: Ensures accuracy in explaining tax compliance and obligations.

Who Should Use This Guide?

-

Tax practitioners

-

Accountants

-

Business consultants

-

Academics

-

Students

With its in-depth and practical approach, this guide is a must-have resource for anyone involved in or studying Malaysia’s tax landscape.